Nevada offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

PUCN Regulated Companies & Service Providers

Nevada Clean Energy Fund

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Nevada Government

Nevada State Capitol

101 N Carson St.

Carson City, NV 89701

(775) 684-5670

[email protected]

Monday – Friday, 8:00 a.m.- 5:00 p.m.

NV Energy

6226 W Sahara Ave

Las Vegas, NV

(702) 402-5555

[email protected]

Nevada Governor’s Office of Energy

600 E. William Street

Suite 200

Carson City, Nevada 89701

(775) 687-7189

[email protected]

Monday – Friday, 8:00 a.m. – 5:00 p.m.

Las Vegas Weather Bureau

7851 S Dean Martin Dr.

Las Vegas, NV 89139-6628

(702) 263-9744

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Nevada Clean Energy

Grid Resilience Formula Grant Program Overview

Home Energy Rebates (Inflation Reduction Act)

Clean Transportation

Green Building Tax Abatements

RETA Application Process

Home Energy Rebates (Inflation Reduction Act)

Email

Power Outage Map

Nevada Governor’s Office of Energy

600 E. William Street

Suite 200

Carson City, Nevada 89701

(775) 687-7189

[email protected]

Monday-Friday

8:00 a.m. to 5:00 p.m.

Nevada Solar Credits Overview

Nevada solar incentives are designed to help residents in the state make the switch to sustainable energy through residential solar panel installation.

Residents of the ‘Silver State’ can benefit from a variety of programs and credits designed to help them save on solar energy systems, and registering for these renewable energy rebates and programs is made easy.

With Nevada solar incentives, residents can disconnect from the grid, lower their energy emissions, or even reduce their overall utility costs by installing a residential solar system.

This comprehensive guide provides details about some of the most well-known and helpful programs that can lower the cost of electricity in Nevada, as well as information about how to calculate the cost of solar arrays you’ll need for your home.

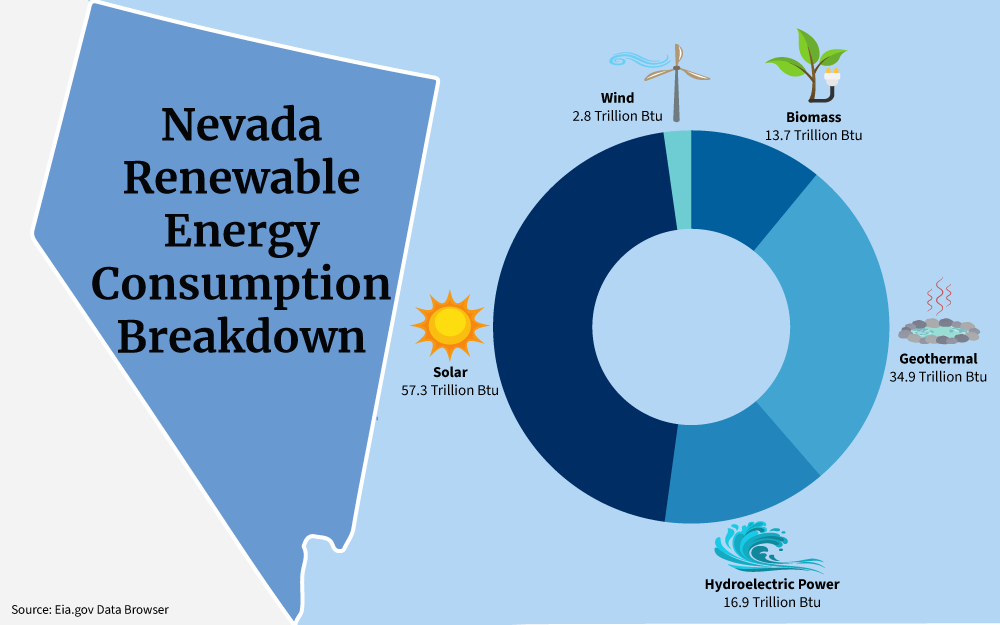

As one of the sunniest states in the country (it gets an average of 252 sunny days per year),1 Nevada is a great candidate for solar panel energy and solar tax credits, ranking sixth out of the nation in solar adoption.

The solar tax credits, rebates and other Nevada renewable energy incentives are designed to increase residential solar use.

Put simply, a solar tax credit — the most well-known one is the federal government’s Residential Clean Energy Credit —2 allows you to reduce your income taxes owed for the year you installed your system.

For systems installed between 2023 and 2032, the federal solar tax credit is 30%. That means you can subtract 30% (which works out to over $7,500 on average)3 of the cost of your panel system from the amount of income tax you owe.

Nevada does not offer any state-specific tax credits or solar incentives. However, the savings produced by the federal credit are enticing enough for many residents to move forward with having solar power installed (especially when they factor in the amount of money they can save on their electric bills as well).

What If I Don’t Owe Taxes?

Keep in mind that the federal solar tax credit is nonrefundable. The government won’t write you a check for the difference if the credit exceeds what you owe.

However, “what if I don’t owe taxes?” is a valid question. In such cases, you can carry forward the unused portion of your tax credit and apply it to your taxes the next year.

Federal Solar Credit Overview

The federal government’s Residential Clean Energy Credit is the primary solar incentive available to Nevada residents.

To qualify for this credit, you must meet certain benchmarks, including the following:

- The solar installation project takes place at your home (a home, in this case, can be a house, mobile home, condominium, manufactured home, or houseboat).

- You own the system (either you paid for it outright or you took out a loan to pay for it). Solar leases don’t qualify.

- You installed your system after 2017 (when the energy credit program began).

You can factor in many aspects of your solar panel installation project when calculating your savings.

Here are some of the most common expenses that apply:

- Solar panels (both solar PV panels and PV solar cells)

- Additional system components (wiring, inverters, mounting equipment, etc.)

- Batteries

- Labor costs (for site preparation, assembly, and installation, as well as permitting, inspection, and developer fees)

- Sales tax on eligible expenses

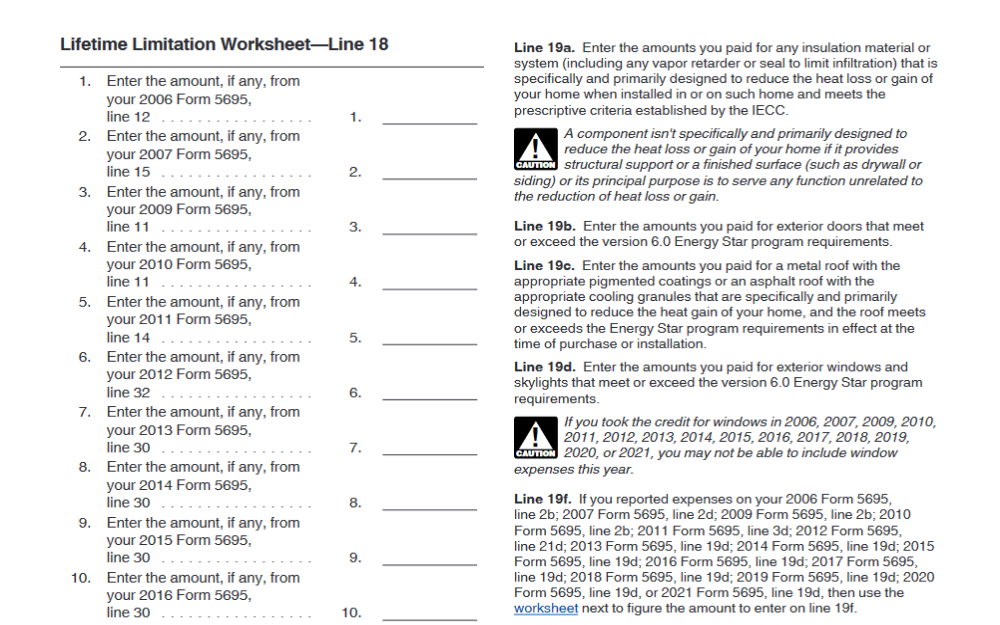

How To Apply for the Federal Solar Tax Credit

Follow these steps if you decide to apply for the Residential Clean Energy Credit to simplify the process and ensure you do it correctly the first time around:

Step 1. Download IRS Form 5695.4

Step 2. Start with Part I of the form and calculate the credit.

Step 3. On line 1, enter the total system and installation costs (reference your solar contract for exact numbers).

Step 4. Complete the calculations listed on lines 6a and 6b. You’ll add the numbers you wrote on lines 1 through 5 for 6a, then multiply the amount of line 6a by 0.30 (30%).

Step 5. Move on to line 14, where you’ll calculate tax liability limitations (more on that in the next section).

Step 6. Complete the calculations listed on lines 15 and 16. Enter the smaller of the two numbers you wrote on lines 13 and 14 to calculate your credit and carryover amount (if applicable).

How To Complete the Residential Clean Energy Credit Limit Worksheet

This worksheet is one of the most confusing parts of applying for the federal solar tax credit. You’ll need your other tax forms — specifically Form 1040 — to complete it correctly.

The IRS also provides detailed instructions to help you with the math:5

- Start with the number from line 18 of your Form 1040,21 1040-NR,22 or 1040-SR.23

- Enter the amounts for other credits that you’re taking, including the following:

a. Foreign Tax Credit

b. Credit for Child and Dependent Care Expenses

c. Credit for the Elderly or the Disabled

d. Nonrefundable Education Credits

e. Retirement Savings Contributions

f. Alternative Motor Vehicle Credit

g. Child tax credit and credit for other Dependents

h. Mortgage Interest Credit

i. Adoption Credit - Subtract the number you get from adding up all the credits listed on Line 2 from the number you wrote on Line 1

- Write that number on Form 5695

Remember that you don’t have to do all this math alone. An accountant will be well-versed in this tax credit and can guide you through the application process to make it less intimidating.

Nevada Energy Storage Incentive and Renewable Energy Programs

The Nevada Energy Storage Incentive is another money-saving program you can benefit from.6 This incentive of up to $3,000 is available to NV Energy customers who add batteries to their solar panel systems.

The specific incentive value varies based on the battery size and whether or not you’re participating in the company’s Time-of-Use (TOU) plan (which allows you to save money by using less energy during peak times).

If you’re on a TOU plan, you can receive $190 per kWh of battery storage capacity, up to either 50% of equipment costs or $3,000 (whichever number is lower). For those not on TOU plans, the incentive is $0.095 per kWh, up to either 50% of equipment costs or $1,500.

NV Energy is not currently accepting incentive applications for the energy storage incentive. However, if you’re interested, you should stay in touch with the company to be alerted when they start taking applications next year.

Nevada Energy Rebates and Qualified Appliance Replacement

In addition to the storage initiative, Nevada Energy also provides free appliance replacement for certain residents throughout the state.

If the appliance is 10 years or older (checked by the model number), and you own or rent your home, qualified residents can register for free appliance replacement.

The income requirements are based on the number of people in the household, and the annual income. You are also required to participate in one other public assistance program.

Residents can find those listed on the Nevada Energy website.

NV Energy Solar Thermal Heating

These Nevada solar incentives apply to both water and thermal heating units, and eligible incentives can total up to $3000, including sizable reductions in installation costs.

Nevada Energy Assistance Program

In addition to the rebates and appliance replacement, eligible residents may also apply for energy cost assistance.

All of the information and conditions are explained on the application.

What Is Needed To Qualify for Solar Credits?

You will likely qualify for net metering in Nevada if you are a customer of NV Energy and have a solar panel system installed on your home.

As for the federal solar credit, the following people are eligible:2

- You’ve installed your system on your primary home (where you live the majority of the time)

- You purchased the system either in cash or through a loan (i.e., you’re not renting or using a power purchase agreement)

If you meet both of those criteria, you’ll also need your solar contract so you can see exactly how much your system costs. With this information, you can fill out the relevant tax forms and incorporate the 30% credit correctly.

How Much Does It Cost for Solar Power Systems?

If you haven’t gone solar in Nevada, it might be because you’re worried about the cost of a solar power system.

To estimate the amount you’ll spend on a system, you’ll need to know two numbers:

- The price per watt (the average cost in Nevada is $2.61 per watt)

- The size of your system (more on that in the following section)

Say you had a 6 kW system (6,000 watts). If you multiply the number of watts by the price per watt, you’ll get $15,660.

After applying the 30% federal credit, the price drops down to $10,970.

How To Make a Solar Panel: Materials and Equipment Needed

Almost all (95%)7 of systems use one of two types of solar panels:8 monocrystalline or polycrystalline.

The differences between these types of broken down in the table below:

| Monocrystalline Panels | Polycrystalline Panels | |

| Characteristics | Made from a single silicon crystal | Made from silicon fragments |

| Pros | Higher efficiency, higher performance | Less expensive |

| Cons | More expensive | Lower efficiency, lower performance |

When considering how to make a solar panel system, be aware that it involves more than just assembling the panels themselves.

The following are some additional aspects of basic solar energy system design:

- Inverters: The inverter converts direct current power to the alternating current power you need for your home.

- Racking/mounting equipment: This equipment attaches the panels securely to your home (typically on the roof or the wall)

- Performance monitoring system: This system makes it easy to monitor how much electricity your panels are generating. It can also alert you to potential problems with your panels sooner.

- Storage options: Some people with solar panels choose to participate in net metering, which involves selling power back to the utility company, but others want to save it for later (such as when they lose power). If you fall into the latter group, you’ll need a battery or another storage option.

Solar Panel Calculator: Requirements and Cost Savings

The cost of your solar panel system will vary significantly depending on its size and the number of panels you need to power your home.

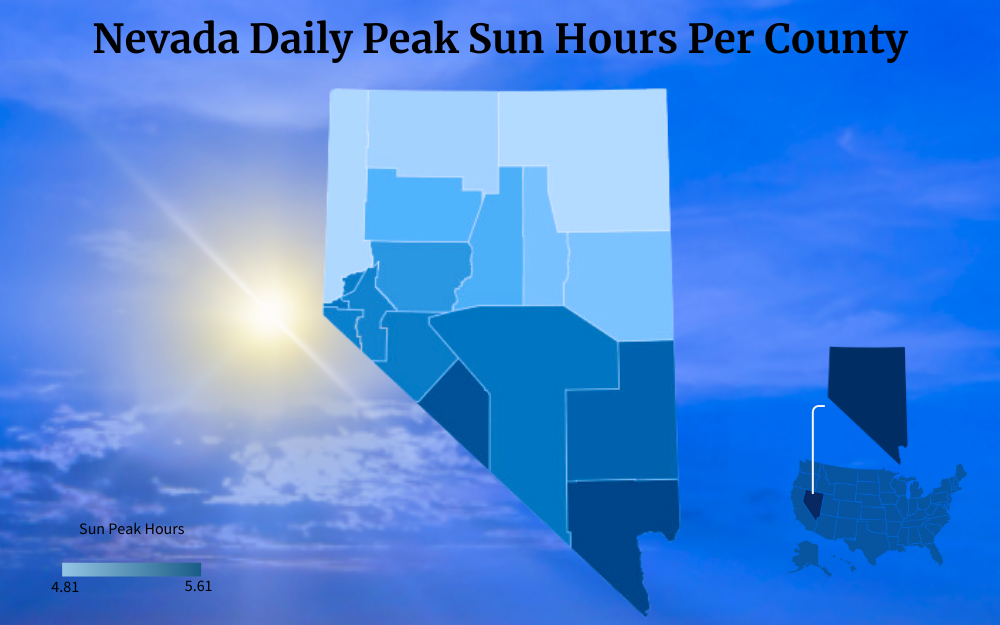

Fortunately, the sunlight hours Nevada gets can help on this.

If you’re not sure how many panels you need, you can use a solar estimator or follow these steps to get a rough estimate:

Step 1: Measure Annual kWh Usage

Reference your electric bills from the past year, adding up the kWh (kilowatt hour) usage from each month. You can also use the average number of kWh hours for Nevada (17,186 kWh,9 which is more than 1.5 times the average usage for the entire United States).10

Step 3: Identify the Panel Wattage

Panel wattage refers to the amount of electricity panels produce under ideal conditions. The average panel wattage ranges from 250-400.

If you don’t know the exact number yet, you can use the average of 250 and 400, which is 325.

Step 3: Estimate the Production Ratio

The production ratio tells you how much solar panel electricity produces based on the average sunlight a location receives.

To get this number, you’ll divide the system wattage by its annual electricity output. Many people also use the country’s average production ratio, which ranges from 1.3 to 1.6.

Step 4: Do the Math

The equation for calculating the number of panels you need is as follows:

- kWh usage/production ratio / wattage = Panel number

Using the numbers from the previous steps, including the lower production ratio, the equation would look like this:

- 17,186 / 1.3 / 325 = 41 panels (rounded up from 40.6)

If you used the higher production ratio (1.6), the total number of panels would be 33 panels.

Remember that these numbers are just estimates. You may need more or fewer depending on the size of your roof, the wattage of the panels, etc.

How Much Can I Save Over the Lifetime of Solar Panels?

If you’re intimidated by the estimated cost of your solar panel system, think about the amount of money you can save.

With the lifetime of solar panels in mind,consider that the average electric bill in Nevada is $238 per month.11 If you start generating power through solar usage, you could theoretically produce enough to eliminate your electric bill (or at least significantly decrease it).

After one year, you could potentially save over $2,800 on power.

How Long Will Solar Panels Last?

Considering the question of “how long will solar panels last,” note that the average lifespan for solar panels is 25-30 years,12 although some can last much longer. Over a 25-year period, saving $2,800 per year would add up to $71,400 (and that’s not factoring in the inevitable ebbs and flows of your energy bills, as well as the cost of electricity).

Is Getting Solar Panels for Free Possible?

There aren’t any options for getting solar panels for free in Nevada. If you can’t afford the upfront cost of a solar panel system, you might want to consider a solar lease.

A solar lease allows you to pay a monthly fee to have panels installed on your roof. If you default on the loan, the panels will be repossessed (just like when you rent a car or apartment).

This option will help to lower your electricity bill. However, you won’t qualify for tax credits since you don’t technically own the system.

How Can I Sell Power to Nevada?

When they look up information on solar panels in Nevada, many people want to know about selling the power their system generates (this is known as net metering).13

If you have residential solar panels (Nevada), you can sign up for a net metering program.

NV Energy,14 the state’s primary utility company, allows customers to roll unused credits over to the next month, which allows you to eliminate your electricity bill for the current month and save significantly on the next month. The credits roll over for 75% of the retail rate.

To apply for NV Energy’s net metering program, you’ll have to go through the following steps:

- You or your contractor sizes and installs the solar panel system.

- You obtain a local jurisdiction inspection from the city or county.

- You or your contractor submit an application through the PowerClerk platform.15

- NV Energy reviews your application and lets you know if they need additional information.

- If your application is approved, NV Energy will install a meter and energize your system.

What About Power Purchase Agreements?

If you have a power purchase agreement or PPA,16 you’re not actually selling power to Nevada. However, that doesn’t mean you’re not getting the benefits of solar panels.

A power purchase agreement takes place between you and a third-party developer. The developer will install and operate a solar panel system on your property.

They’re also the owner. Your role in the agreement is to purchase the energy produced by the system (the cost is usually lower than what your monthly electric bill would be), typically at a fixed cost.

You also don’t have to worry about the upfront cost of solar panels, so it’s a good option for those who don’t have the cash and don’t want to or can’t take out a loan.

One of the problems with solar energy accessed this way is that you don’t get to participate in net metering or claim tax credits associated with your system. Because you’re not the system’s owner, these things don’t apply to you.

How To Find NV Solar Panels

At this point, you’re familiar with the solar panel environmental impact and the financial benefits, and you’re ready to move forward with finding solar panels for your home.

Here are some best practices that will help you choose the right solar panel installer:

Read Reviews

Start by looking up online reviews from past customers. Does the company, overall, have a positive rating?

Do past customers say they would recommend this contractor to friends or family?

You can also ask for references from a contractor you’re thinking about hiring. References can provide more in-depth insights and help you make a more informed decision about which professional you want to hire.

Ask About Their Experience

Pretty much any technician can answer questions like “what does a solar panel do?” but that doesn’t mean they’re necessarily qualified to install your panels.

Ask more specific questions about their experience, such as how long they’ve been in business, how many houses they’ve worked on, what kind of training they went through, etc.

Request Warranty Information

Choose an installation company that offers a warranty on your solar panel system. A warranty will give you peace of mind and reassure you that if something breaks or malfunctions, you can get the system repaired promptly and affordably.

Get a Quote

Always get a detailed quote before agreeing to work with any solar contractor. Ideally, you’ll get quotes from a few different contractors, and then compare them side by side so you can make an educated decision.

The quote should break down the specific equipment the system requires, the estimated electricity production, and the estimated labor costs. Remember that even if you’re not a solar panel expert, you should be able to look over the quote and understand how the technician reached the number they quoted you.

Don’t Give In To Pressure

Some solar panel salespeople, especially those who sell door-to-door or over the phone,17 can be especially pushy. They might try to convince you to sign up for a system without reading the fine print of the contract or understanding exactly what you’re agreeing to.

Remember that you have a right to know what you’re paying for and what you’re signing. Take your time and don’t let anyone pressure you into making a choice before you’re ready.

Going solar in Nevada can help you save a lot of money each month — especially if you participate in programs like net metering and apply for the federal solar tax credit — while also minimizing your environmental impact.

Use the information shared above to ensure you apply for Nevada solar incentives, calculate an accurate estimate for the price of your solar panel system, and find other rebates and loan options to make solar energy affordable for everyone.

Frequently Asked Questions About Nevada Solar Incentives

Are There Any Legal Protections for Customers in Nevada?

Nevada’s Assembly Bill 405 (AB 405) codifies the rights of renewable energy customers,18 including detailed requirements for solar lease agreements such as payment terms, installation timelines, and warranty descriptions.

Known as the Renewable Energy Bill of Rights, these provisions apply to solar leases, solar panel system purchases, and power purchase agreements, so it’s essential to consult them before signing any solar-related contract.

How Can I Tell if a Solar Panel Contractor Is Legitimate?

One way to determine the legitimacy of a contractor is by checking that their license is valid and up to date using the Nevada State Contractors Board’s online license search tool.19 You can easily enter the contractor’s license number, or alternatively their name or company name, and click “Submit” to access the relevant information.

Can You Purchase Solar Energy From Solar Farms in Nevada?

There are several solar farms in Nevada, and NV Energy recently introduced a program, known as the Expanded Solar Access Program or ESAP that lets a limited number of business and residential customers access electricity from community-based solar resources,20 even if they don’t have a solar panel system installed on their properties. This program is open to low-income individuals whose income does not exceed 80% of the area’s median income.

References

1Sperling’s Best Places. (2023). Climate in Nevada. Best Places. Retrieved September 11, 2023, from <https://www.bestplaces.net/climate/state/nevada>

2Internal Revenue Service. (2023, August 28). Residential Clean Energy Credit. IRS. Retrieved September 11, 2023, from <https://www.irs.gov/credits-deductions/residential-clean-energy-credit>

3Solar Energy Technologies Office. (2023, September 8). Solar Investment Tax Credit: What Changed? Retrieved September 11, 2023, from <https://www.energy.gov/eere/solar/articles/solar-investment-tax-credit-what-changed>

4Internal Revenue Service. (2023, February 17). About Form 5695, Residential Energy Credits. IRS. Retrieved September 11, 2023, from <https://www.irs.gov/forms-pubs/about-form-5695>

5Internal Revenue Service. (2023). 2022 Instructions for Form 5695. IRS. Retrieved September 11, 2023, from <https://www.irs.gov/pub/irs-pdf/i5695.pdf>

6NV Energy. (2023). Energy Storage Incentives. NV Energy. Retrieved September 11, 2023, from <https://www.nvenergy.com/cleanenergy/energy-storage>

7Kurtz, S., Jones-Albertus, R., Feldman, D., Fu, R., Horowitz, K., Chung, D., Jordan, D., & Woodhouse, M. (2016, May). On the Path to SunShot: The Role of Advancements in Solar Photovoltaic Efficiency, Reliability, and Costs. NREL. Retrieved September 11, 2023, from <https://www.nrel.gov/docs/fy16osti/65872.pdf>

8Solar Energy Technologies Office. (2023, December 3). PV Cells 101: A Primer on the Solar Photovoltaic Cell. Energy Efficiency & Renewable Energy. Retrieved September 11, 2023, from <https://www.energy.gov/eere/solar/articles/pv-cells-101-primer-solar-photovoltaic-cell>

9EnergySage, Inc. (2023, September 10). Cost of electricity in Las Vegas, NV. ENERGYSAGE. Retrieved September 11, 2023, from <https://www.energysage.com/local-data/electricity-cost/nv/clark-county/las-vegas/>

10U.S. Energy Information Administration. (2022, October 12). How much electricity does an American home use? U.S. Energy Information Administration. Retrieved September 11, 2023, from <https://www.eia.gov/tools/faqs/faq.php?id=97&t=3>

11EnergySage, Inc. (2023, September 10). Cost of electricity in Nevada. EnergySage. Retrieved September 11, 2023, from <https://www.energysage.com/local-data/electricity-cost/nv/>

12US Environmental Protection Agency. (2023, August 17). End-of-Life Solar Panels: Regulations and Management. US EPA. Retrieved September 11, 2023, from <https://www.epa.gov/hw/end-life-solar-panels-regulations-and-management>

13State of Nevada. (2021). Net Metering in Nevada. NV.gov. Retrieved September 11, 2023, from <https://puc.nv.gov/Renewable_Energy/Net_Metering/>

14NV Energy. (2023). NMR-405, Tier 4 Overview. NV Energy. Retrieved September 11, 2023, from <https://www.nvenergy.com/account-services/energy-pricing-plans/net-metering/nmr-405>

15Clean Power Research, L.L.C. (2023). Welcome to NV Energy’s portal for net metering applications! NV Energy. Retrieved September 11, 2023, from <https://nvenetmeter.powerclerk.com/MvcAccount/Login#xd_co_f=NjE3YTY3NjEtNzEwNy00YWIzLTg2OTAtNzVmYTM5NjVhYmM2~>

16U.S. Department of Energy. (2023). Better Buildings Financing Navigator. Better Buildings. Retrieved September 11, 2023, from <https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/power-purchase-agreement>

17State of Nevada. (2023, March 8). For National Consumer Protection Week, Attorney General Ford Warns Nevadans about Solar Scams. NV.gov. Retrieved September 11, 2023, from <https://ag.nv.gov/News/PR/2023/For_National_Consumer_Protection_Week,_Attorney_General_Ford_Warns_Nevadans_about_Solar_Scams/>

18Legislative Counsel Bureau. (2023). – 79th Session (2017) Assembly Bill No. 405–Assemblymen. Nevada Legislature. Retrieved September 11, 2023, from <https://www.leg.state.nv.us/Session/79th2017/Bills/AB/AB405_EN.pdf>

19The Nevada State Contractors Board. (2023). License Search. The Nevada State Contractors Board. Retrieved September 11, 2023, from <https://app.nvcontractorsboard.com/Clients/NVSCB/Public/ContractorLicenseSearch/ContractorLicenseSearch.aspx>

20NV Energy. (2023). Expanded Solar Access Program (ESAP). NV Energy. Retrieved September 11, 2023, from <https://www.nvenergy.com/cleanenergy/solar/expanded-solar-access-program>

21Internal Revenue Service. (2023). Form 1040. IRS. Retrieved September 14, 2023, from <https://www.irs.gov/pub/irs-pdf/f1040.pdf>

22Internal Revenue Service. (2023). Form 1040-NR. IRS. Retrieved September 14, 2023, from <https://www.irs.gov/pub/irs-pdf/f1040nr.pdf>

23Internal Revenue Service. (2023). Form 1040-SR. IRS. Retrieved September 14, 2023, from <https://www.irs.gov/pub/irs-pdf/f1040s.pdf>

24Screenshot from IRS. Internal Revenue Service. Retrieved from <https://www.irs.gov/pub/irs-pdf/i5695.pdf>